|

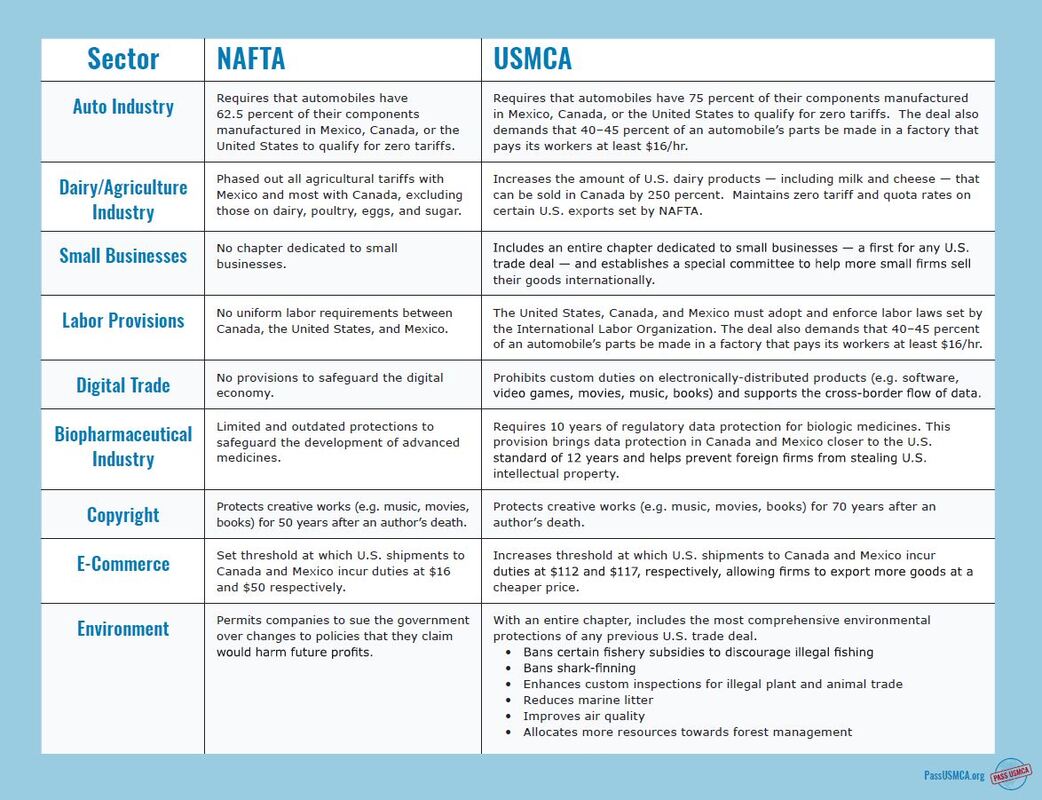

Confused about the difference between NAFTA and USMCA? Check out this graphic from PNWER partner the Pass USMCA Coalition.

0 Comments

The following PNWER statement on tariffs was released on November 15, 2018, during the PNWER Economic Leadership Forum in Whitehorse, Yukon. ------------- UNWARRANTED TARIFFS ARE DISRUPTING TRADE BETWEEN THE WORLD’S CLOSEST ALLIES & LARGEST TRADING PARTNERS AND NEGATIVELY IMPACTING REGIONAL SUPPLY CHAINS

WHITEHORSE, YUKON - “We believe that unilateral tariffs between the US and Canada go against the principles of free and fair trade and only harm industries in both countries. When markets are open, and goods are transported freely across borders, the results are economic growth, new businesses and more and better job opportunities for individuals.”, said Pacific NorthWest Economic Region (PNWER) President Larry Doke, MLA Saskatchewan at the PNWER Economic Leadership Forum in Whitehorse, Yukon, on Thursday. Oregon Senator Arnie Roblan, Past President of PNWER said, “Here in the Pacific Northwest, we are stronger by working closely together, and our relationships are intact because of the ongoing partnerships in every major sector of our economy, and in state, provincial, territorial, local, and tribal governments. The US should exempt Canada from any steel and aluminum tariffs, which are causing significant disruption to the largest trading relationship in the world.” The US and Canada’s trading relationship is incredibly important to the Pacific Northwest. The US and Canada have the largest trading relationship in the world, and here in the Pacific Northwest, we benefit from the two-way trade of over USD $541 billion (CAD $630 billion) annually, of which about USD $22.6 billion (CAD $29 billion) is in the Pacific Northwest. Protectionism is seriously damaging the vital economic regional partnership in both of our countries. The steel and aluminum tariffs may cost the US and Canada over USD $11 billion combined, and we could see losses of over 6,000 jobs, according to CD Howe Institute, a Canadian independent not-for-profit research institute fostering economically sound public policies. As a result of the steel and aluminum tariffs, retaliatory tariffs from Mexico and Canada could cause US Agriculture exports to decline by USD $1.9 billion to these two trading partners. The US tariffs on Canadian steel and aluminum products based on Section 232 US national security investigations are of great concern. As a trusted ally and partner, Canadian steel and aluminum products are used as vital inputs in the Canada-US manufacturing supply chains. Tariffs on these critical inputs are not only making consumer goods expensive in both countries, but also making North American products uncompetitive in international markets. This cross-border region continues to work closely together every day with our interconnected and interdependent supply chains, and dozens of cross-border cooperative agreements on everything from our shared transboundary watersheds, cross-border airsheds, climate action, cross-border law enforcement, invasive species prevention, forest fire prevention, to defending our shared borders in the 60-year-old NORAD (North American Air Defense) System. PNWER is an example of these interconnections and the ongoing relationships that make our bi-national region stand out in North America as a place where innovation happens, precisely because of the multi-faceted relationships of trust that have been built up for the past 30 years. ### PNWER NAFTA Renegotiation Task Force - Update on the changing landscape of the NAFTA Negotiations8/31/2018

Following a flurry of activity this week, NAFTA talks between the US and Canada have concluded for the week. This follows off-the-record comments made by Trump, and made public by the Toronto Star on Friday that Trump does not want to compromise with Canada.

Minister Chrystia Freeland spoke following the conclusion of talks today. "The United States and Canada have now agreed to negotiate beyond the Friday deadline. While members of Congress could theoretically object, they are unlikely to do so, since most are eager for Canada to remain part of the pact." Talks between the US and Canada are expected to resume again next week. This latest news has created more uncertainty in an already uncertain future for an agreement. But there is still hope that a new free trade deal will include Canada. On late Friday, the Trump Administration sent Congress a letter formally notifying of their intention to sign a trade deal with Mexico. While the letter only signaled a deal with Mexico, there is still time for Canada to be included. This letter is required for the administration to sign a trade deal under "fast-track" authority, which requires a straight up or down vote by Congress for approval. This letter starts the 90-day clock before the earliest date that a deal can be signed. Earlier this week, the US reached a bi-lateral trade deal with Mexico, and Trump announced his intention to rename the agreement from NAFTA. Canada rejoined NAFTA talks after sitting out while the US and Mexico worked on negotiating a trade deal. Canada resumed talks to negotiate bi-lateral and tri-lateral issues and look at creating a tri-lateral deal between the three countries. However, following an eventful Friday, talks have concluded. They are expected to resume again next week. Other Links and Resources: NAFTA 2.0 End Game Briefer - Canada Institute - Aug. 30 What to watch as Canada looks for a breakthrough in NAFTA talks - Financial Post - Aug. 31 Friday isn’t the real deadline for ‘NAFTA 2.0’ - The Washington Post - Aug. 30 COLIN ROBERTSON THE GLOBE AND MAIL AUGUST 28, 2018: A little more than a year after negotiations began on a revised North American free-trade agreement, a deal looks possible, although big questions remain. For much of the past two months, Mexican and American negotiators have wrestled with the U.S. demand around the content rules for our most-traded commodity, the automobile. North Americans produce 17.5 million cars or trucks annually. The original U.S. demand of 85 per cent North American content with 50 per cent of that “Made in the USA” has apparently morphed into 75 per cent North American content with 40 per cent to 45 per cent made by workers making US$16 or more a hour. The devil is always in the details, but Canadian industry and its workers can live with this and, if this gives U.S. President Donald Trump his “win,” then we are on our way to a deal.So, too, with the “sunset” clause. Originally, the United States wanted the new agreement to lapse after five years – something investors said would freeze investment, especially into Canada and Mexico. U.S. Trade Representative Robert Lighthizer reportedly says it will now be 16 years with a review after six years. We can live with that. On dispute settlement, or Chapter 19, the picture is murky and we will need clarification. The Trump team originally wanted to jettison the binational mechanism, and it appears there will be investor-state provisions, something U.S. industry lobbied hard to retain, and some form of recourse, beyond the U.S. system, for energy and infrastructure. Canada and Mexico need to stand firm. We need recourse from U.S. trade-remedy legislation – countervail, anti-dump and, as the Trump administration misapplies it, national security. If reports are accurate, there appears to be near-agreement on agriculture (good for Canadian farmers) and on intellectual property (unchanged) but again, the devil will be in the details. The negotiators were originally aiming for 30-plus chapters of NAFTA but until now only nine had been closed and, of course, nothing is truly closed until it is all done. So what remains and how might they be resolved? From Canada’s perspective, assuming we can work out dispute settlement, we need to see action on three more items.

The coming days – more likely weeks – will be a test of Canadian negotiators. They are a very experienced team and they are up to the task as long as the government has their backs. This is the bigger question: Can the Trudeau government take the political flak that will inevitably come its way? It won’t be sunny ways. If it can stick it out, the Trudeau government will make as big a contribution to Canadian well being and competitiveness as Brian Mulroney and his Progressive Conservative government did with the original Canada-U.S. FTA and then the NAFTA. It would be no small legacy. ___________________________________________________________________________________________________________ PNWER will continue to monitor events next week as this process unfolds. Thank you for your interest and support of the greatest trading relationship in the world. We remain committed to seeing a renegotiated NAFTA that will be a win-win for all three countries, and that will reinforce the strength of the North American integrated economy, and enhance our competitiveness in global markets. Dickinson Wright (@dickinsonwright) advises that we are entering the “Summer of Disruption” to global trade based on five (5) categories of recent US actions and other countries’ responses:

As a result, when companies return from their Canada Day and Fourth of July parades and picnics, the global trade environment will experience the US imposing nearly $200 billion in tariffs on ferrous metals and China-sourced goods, and US exports subject to nearly $75 billion in retaliatory tariffs ($34 billion from China/$40 billion for Canada, EU, and Mexico). The overarching question is whether the US will be moving toward its objective of achieving “rebalanced” trade, or whether the global economy will be rapidly moving toward recession. Companies cannot wait for the answer. Contingency planning is a must. You can find background on these developments, as well as a sampling of Dickinson Wright’s comments in global media, as follows: https://apnews.com/1ca6036369df43fe868e8edd348eb3c9 (G7 NAFTA) https://www.theglobeandmail.com/business/article-nafta-negotiators-aim-to-make-deal-this-summer-foreign-minister/ (NAFTA and tariffs) https://www.theglobeandmail.com/business/article-nafta-negotiators-aim-to-make-deal-this-summer-foreign-minister/ (NAFTA and steel/aluminum) https://www.theglobeandmail.com/politics/article-freeland-headed-back-to-washington-in-bid-to-reignite-nafta-talks/ (steel and aluminum) https://www.theglobeandmail.com/business/article-whats-at-stake-if-the-us-slaps-tariffs-on-canadian-auto-exports/ (auto tariffs) https://insidetrade.com/daily-news/sources-administration-pushing-finish-auto-investigation-midterms (auto tariffs) 1. Section 301 Tariffs on Imports from China The Office of the United States Trade Representative (USTR) released on June 15, 2018 a list of products imported from China that will be subject to additional tariffs as part of the US response to China’s purported unfair trade practices. The action came following after a Section 301 investigation in which USTR found that China’s acts, policies and practices related to technology transfer, intellectual property, and innovation were unreasonable and discriminatory, and burdened U.S. commerce. The list of products https://ustr.gov/sites/default/files/2018-0018%20notice%206-15-2018_.pdf covers 1,102 separate US tariff lines valued at approximately $50 billion in 2018 trade values. This list of products consists of two sets of US tariff lines. The first set contains 818 lines of the original 1,333 lines that were included on the proposed list published on April 6. These lines cover approximately $34 billion worth of imports from China. USTR has determined to impose an additional duty of 25 percent on these 818 product lines after having sought and received views from the public. US Customs and Border Protection will begin to collect the additional duties on July 6, 2018. The second set contains 284 new tariff lines. These 284 lines, which cover approximately $16 billion worth of imports from China, will undergo further review in a public notice and comment process with written submissions due July 23, 2018 and a public hearing will be held on July 24, 2018. Parties desiring to appear at the hearing must submit a request and proposed testimony on or before June 29, 2018. After completion of this process, USTR will issue a final determination on the products from this list that would be subject to the additional duties. USTR also has advised that it will be establishing procedures for product exclusions. Dickinson Wright will circulate notices regarding that process as they become available. Unsurprisingly, China immediately announced that it would target $50 billion of US goods in two phases. http://gss.mof.gov.cn/zhengwuxinxi/gongzuodongtai/201806/t20180616_2930323.html The first phase on $34 billion of goods is slated to take effect on July 6 and targets soy, cars, sorghum, fish, pork, and cotton. Additional duties on $16 billion worth of US goods, including chemicals, medical equipment and energy products, will be finalized later. President Trump has threatened additional tariffs against nearly $100 billion of China-sourced goods if Beijing retaliates. No talks between the US and China are planned before the July 6 deadline. Also factoring into the US-China trade talks is that the US Treasury Department has until July 30 to decide new rules and restrictions on China-sourced investments into the US. · What Should We Do? Do not wait for July 6. The procedural, policy, and political factors all indicate that the first phase of US tariffs and China’s retaliation will occur. All companies should review (and review again) the list of products to determine potential exposure to the US Section 301 tariffs and China’s retaliation. In the event companies are subject to tariffs as of July 6, 2018, please contact Dickinson Wright and we can assist in preparing a product exclusion request once that process if fully established. In the event that your company may be impacted by one of the 284 product lines, it is imperative to participate in the written submissions and hearings. Notably, USTR removed 515 product lines from the original target list based on submissions received from companies. Dickinson Wright will monitor all developments and assist upon request. 2. Section 232 Steel and Aluminum Tariffs—The US has imposed 25% tariff ad valorem on steel and 10% ad valorem on aluminum imports into the United States from all countries previously subject to the tariffas well as the European Union, Canada, and Mexico. (Steel) https://www.whitehouse.gov/presidential-actions/presidential-proclamation-adjusting-imports-steel-united-states-4/ (Aluminum) https://www.whitehouse.gov/presidential-actions/presidential-proclamation-adjusting-imports-aluminum-united-states-4/ Korea, Australia, Argentina, and Brazil received long-term exemptions from the tariffs in varying degrees based on commitments to quotas or other measures (if you are importing steel and, or, aluminum from these countries, please review US-CBP guidance on the issue or request assistance from Dickinson Wright). As further predicted, the EU, Canada, and Mexico announced retaliatory measures. These retaliation lists include items tied to the steel and aluminum industry as well as products from key congressional districts and other political pressure points. Mexico imposed retaliatory measures on June 6 ranging from 10%-25% on nearly $3 billion worth of US goods. (See attached report from Dickinson Wright’s Mexico-based ally IQOM.) These included steel, aluminum, bourbon, pork bellies, blueberries, apple, grapes and some cheese. However, Mexico did not impose retaliatory tariffs on US grains (nearly $4 billion) but is exploring whether or not to do so if the US imposes more tariffs. The EU approved its 10 page list of retaliation targets zeroing in on $3.3 billion worth of goods on June 14, 2018 and implementation is expected in July (if not before). http://trade.ec.europa.eu/doclib/docs/2018/march/tradoc_156648.pdf. Canada released its list of countermeasures against US imports www.fin.gc.ca/activty/consult/cacsap-cmpcaa-eng.asp and the public comment period is now closed. These measures will be implemented on July 1, 2018.

We anticipate that the retaliatory measures will be fully implemented against the US. It is imperative that companies monitor the retaliation lists to ensure that their goods will not be impacted by retaliatory tariffs. Dickinson Wright has produced a webinar to explain the retaliation process and strategies.http://www.dickinsonwright.com/events/canada-to-impose-tariffs-webinar In the event that retaliatory measures impact a company, Dickinson Wright can assist with working with the foreign government to potentially minimize the consequences. 3. NAFTA—The NAFTA has been on life support since the start of June. Beginning with Twitter spats between President Trump and Prime Minister Trudeau; to brief optimism at the G7 that was abruptly darkened by post-summit news conferences, social media, and Sunday new shows; to speeches and meetings in Washington this week to cool the temperature; to strong and credible rumors that the White House was seriously considering withdrawing from NAFTA over the Fathers’ Day weekend—the past week to 10 days has been a roller coaster for North American trade. The prevailing view at the moment is that the NAFTA will be on hold until after the July 1 Mexican elections. A Ministerial meeting between the three countries likely will be held in mid-July where there may be an opportunity to close the NAFTA auto rules of origin chapter and address the steel and aluminum tariffs. However, it is important to note that while the parties may reach a deal in the Summer of 2018, the procedural and political calendars are closed for ratification by the end of the year. It will be up to the next US Congress to ratify any deal. And with Canada having a federal election in 2019 and the public rallying around Prime Minister Trudeau’s “get tough on Trump” stance, it will be interesting to see if Canada can make any concessions. · What Should We Do? While there may be noise around the NAFTA over the coming weeks, we do not see any meaningful activity happening until after the July 1, 2018 election in Mexico. There may be an attempt right after those elections to agree on framework for the automotive rules of origin that will include a steel and aluminum threshold in exchange for lifting the tariffs, and the parties then will agree to continue negotiating on other topics throughout the Fall. At this time, we do not envision NAFTA being completed and ratified in 2018. We likewise do not view that a US withdrawal will occur. We do believe, however, that the process will be very bumpy over the coming months. The status quo will remain for 2018, but not without a great deal of noise and saber-rattling. 4. Trade Promotion Authority 2015 Extension—All of this activity is occurring against the backdrop of the President’s Trade Promotion Authority (TPA aka “fast track”) expiring on June 30, 2018. While TPA has no role in Section 232 tariffs, it is the primary authority through which the President is negotiating the NAFTA and potentially will deal with UK, Japan and others. Pursuant to the statute, the President requested an extension of TPA until 2021. While Congress is not required to affirmatively approve the extension, Congress may file a “disapproval resolution” of the request. A report on the extension was filed by the International Trade Commission https://www.usitc.gov/publications/332/pub4792.pdf and the private sector USTR Advisory Committee on Trade Policy and Negotiations (see attached ACTPN Report) supporting extending TPA until 2021. We anticipate that TPA will be extended. On the Section 232 front, US Senator Bob Corker (R-TN) and US Senator Pat Toomey (R-PA) each tried to pass legislation this week limiting the President’s ability to impose Section 232 tariffs—to no avail. It appears that Congress will not take on POTUS in 2018 regarding trade; however, Dickinson Wright sources have advised that NAFTA withdrawal and Section 232 auto tariffs would be red-lines for Congress. Nevertheless, companies should not rely on Congress to stop the Trump trade agenda. 5. Section 232 Investigation into Auto Imports—As previously indicated, the US Department of Commerce (DOC) published a notice in the May 30, 2018 Federal Register regarding its proposed national security investigation into the imports of automobiles including cars, vans, SUVs, light trucks and automotive parts. https://www.gpo.gov/fdsys/pkg/FR-2018-05-30/pdf/2018-11708.pdf The Notice seeks input from companies in the following areas:

Any interested party may file a written submission on or before June 22, 2018. Rebuttals may be filed on or before July 6, 2018. Procedures are in place to ensure confidentiality of proprietary/sensitive information. A public hearing will be held on July 19 and 20, 2018. Parties may request to appear at the hearing by June 22, 2018. The Secretary of Commerce has a total of 270 days to conduct an investigation and present the DOC’s findings and recommendations to the President. If the Secretary finds that an import threatens to impair US national security, the President shall determine whether he agrees with those findings within 90 days. If so, he must determine what, if any, action to implement to “adjust” the imports of the article in question so that they will not threaten to impair national security. Dickinson Wright previously indicated that we not believe that the President will elect to impose tariffs before the close of 2018 and certainly not before the November 2018 midterm elections. Our new information suggests that the tariffs may be issued in Fall 2018, likely in October. See full story below from Inside Trade with Dickinson Wright comments.

Dickinson Wright is engaged in all of these activities. We are happy to discuss and assist at any time. Best, Dan Daniel D. Ujczo Practice Group Chair - Intl & Regional Practices https://www.linkedin.com/in/daniel-ujczo-893b486b June 13, 2018

President Donald J. Trump The White House 1600 Pennsylvania Avenue NW Washington, DC 20500 Dear President Trump, From a regional perspective in the Pacific Northwest, disrupting trade between the world’s closest allies and largest trading partners is a bad idea. Oregon Senator Arnie Roblan, current President of PNWER: “Here in the Pacific Northwest, we are stronger by working closely together, and our relationships are intact because of the ongoing partnerships in every major sector of our economy, and in state, provincial, territorial, local, and tribal governments. The US should exempt Canada from any steel and aluminum tariffs before July 1 and avoid significant disruption to the largest trading relationship in the world.” The US and Canada’s Trading Relationship is incredibly important to the Pacific Northwest. The US and Canada have the largest trading relationship in the world, and here in the Pacific Northwest, we benefit from the two way trade of over $630 Billion annually, of which $22 Billion is in the Pacific Northwest. Protectionism will seriously damage the vital economic regional partnership in both of our countries. The steel and aluminum tariffs may cost the US and Canada over $11 Billion combined, and we could see losses of over 6,000 jobs, according to CD Howe Institute, and this is likely to reduce North American competitiveness and drive competitive gains for China, Japan, and the EU. This cross border region continues to work closely together every day with our interconnected and interdependent supply chains, and dozens of cross border cooperative agreements on everything from our shared transboundary watersheds, cross border airsheds, climate action, cross border law enforcement, invasive species prevention, forest fires prevention, to defending our shared borders in the 60 year old NORAD (North American Air Defense) System. The Pacific NorthWest Economic Region (PNWER) is an example of these interconnections, and the ongoing relationships that make our bi-national region stand out in North America as a place where innovation happens, precisely because of the multi-faceted relationships of trust that have been built up for the past 30 years. PNWER Vice President of Canada, MLA Larry Doke (SK): “We are each other’s largest trading partners, and this benefits people on both sides of the border. We owe it to our constituencies to do everything we can to avoid creating an escalating trade dispute, which no one will win, and to work toward a modernized NAFTA agreement.” Sincerely, Sen. Arnie Roblan President 2017-2018 Oregon State Legislature Matt Morrison PNWER Chief Executive Officer PNWER CC: Senate President Senator Mitch McConnell Senate Minority Leader Senator Charles Schumer Senator Orrin Hatch, Chair of Senate Finance Committee Senator John Cornyn, Chair of Senate Finance, International Trade, Customs, and Global Competitiveness Subcommittee Speaker of the House Representative Paul Ryan Minority Leader Representative Nancy Pelosi Representative Kevin Brady, Chair of House Ways and Means Committee Representative David Reichert, Chair of House Ways and Means Trade Subcommittee Congressional Delegations from Alaska, Washington, Oregon, Montana, and Idaho Mr. Wilbur Ross, United States Secretary of Commerce Mr. Robert Lighthizer, United States Trade Representative Mr. Douglas Hoelscher, Special Assistant to the President, Deputy Director of Intergovernmental Affairs Full Text of Letter In response to the May 31st US steel and aluminum decision, PNWER reiterates the importance of a "stable, reliable, and open trade relationships with Canada". Canada should be permanently exempted from steel and aluminum tariffs.

The PNWER Executive Committee sent the following letter to the US President stressing the importance of the integrated North American market, negative impact of tariffs on US workers, and the proud history of US-Canadian national security cooperation. Full Text Here PNWER CEO Matt Morrison spoke to a local Seattle news station on the trade dispute. "Morrison pointed out that Washington is the most trade-dependent state in the country. It doesn't matter if they're coming from Canada or Mexico -- the price of steel will go up and the price of aluminum will go up, and everything else. This is going to have an impact on our economy,” Morrison said. Video of the interview is here The past week—officially (and ironically) dubbed “World Trade Week” by the US White House (link) — witnessed significant trade policy developments for automotive manufacturers and suppliers. However, the deadlines presented in the coming week (May 28-June 2) may lead to even greater disruption in the auto and advanced manufacturing sectors and require close attention.

You can find background on these developments, as well as a sampling of Dickinson Wright’s comments in global media, as follows:

Looking ahead to next week, Dickinson Wright encourages companies to be aware of the following five (5) trade issues: 1.Section 232 Investigation into Auto Imports— The “headline-grabbing” news of the past week was that US President Donald Trump ordered the US Department of Commerce (DOC) to launch a Section 232 national security investigation into automobile imports. It was reported that President Trump asked for additional tariffs between 20-25%. According to a statement issued by DOC, the investigation will “determine whether imports of automobiles, including SUVs, vans, light trucks, and automotive parts into the United States threaten to impair the national security.” (Emphasis added.) The Secretary of Commerce has 270 days to conduct an investigation and present the DOC’s findings and recommendations to the President. If the Secretary finds that an import threatens to impair US national security, the President shall determine whether he agrees with those findings within 90 days. If so, he must determine what, if any, action to implement to “adjust” the imports of the article in question so that they will not threaten to impair national security.

2.Section 232 Steel and Aluminum Tariffs—Of greatest immediate impact, the deadline for the Trump Administration to extend or grant country exemptions from the Section 232 steel and aluminum tariffs is fast approaching, without any resolution in sight. The Trump Administration has already imposed 25% tariff ad valorem on steel and 10% ad valorem on aluminum imports into the United States from all countries (as of March 23, 2018), with the exception of a few countries as to which the Trump Administration is negotiating country-wide exemptions from tariffs, including Canada, Mexico, and the European Union. Only South Korea has received a permanent exemption from the tariffs, in exchange for concessions in trade negotiations and establishing quotas (which are largely filled). It is highly unlikely that any new major country exemptions—such as for Japan—will be granted. Dickinson Wright also anticipates, barring any developments over the next week, that it is unlikely that the EU and Mexico will continue to have country exemptions beyond . Similarly, it is unlikely that Canada will maintain its country exemptions. Again, Dickinson Wright does not expect Canada, Mexico, and the EU to have country exemptions past June 1 unless there is significant developments over the next week.

Additionally, Canada, Mexico, and the EU (as well as other affected countries) thereafter will publish lists of items upon which that country will impose retaliatory tariffs. These products include steel and aluminum products as well as any product that may be of practical and political importance to the US (there is no requirement that it be linked to steel and aluminum production). It is imperative that companies monitor those retaliation lists to ensure that its goods will not be impacted by retaliatory tariffs. In the event that retaliatory measures impact a company, Dickinson Wright can assist with working with the foreign government to potentially minimize the consequences. 3.NAFTA—The past week witnessed a flurry of activity targeting the NAFTA modernization process. While there were several reports of potential concessions that were made by Mexico and the US over the past week, Dickinson Wright’s current intelligence is that the negotiations are at an impasse. Automotive Rules of Origin (ROO) are at the top of several key sticking points. Specifically, the US presented it most recent auto ROO “proposal” (without formal text) in late April/early May, which the Mexican negotiating team considered and countered during the week May 7. While Mexico’s counterproposal included all of the key “elements” contained in the US proposal—including wage requirements and a steel and aluminum threshold—the parties differed on the number/percentages. Mexico also required that, in exchange for its concessions on auto ROO, the US would make concessions on other controversial areas such as a “sunset clause” (reauthorizing the NAFTA every five years), seasonal produce, and dispute resolution. The US immediately rejected the proposal and Mexico withdrew its request. No new offer has been tabled by any party. The US proposal was a 75% top line regional value content for auto ROO, of which 40% (45% for light duty trucks) of the final assembly must be produced at the North American Average Wage (approx. $15-$17). Up to 15% (20% for light duty trucks) of that North American Average Wage requirement could include R&D, marketing, sales, etc. salaries. The US proposal also required that 70% of all steel and aluminum originate in North America. The US further proposed 2, 4, and 9 year phase-in requirements, depending on the components, with autonomous and electric vehicles having the longest phase-in period. For its part, Mexico advanced a top-line RVC of 70% (as opposed to the US’ 75%) of which 20% (30% for light duty pickup) must be assembled at the North American Average Wage. Mexico counter-proposed steel (30%) and aluminum (20%) thresholds. Mexico’s counterproposal included a 10 year phase-in period. Mexico’s overarching concern was that only a limited percentage of its auto production could comply with all of the elements. Consequently, Mexico’s proposal included certain options/credits for companies that complied with some, but not all, of the elements. The full contours of that component of the proposal remain unclear and may be in flux. The inability to reach an agreement in principle on auto ROO has prevented the parties from reaching any resolution. Over the course of the past ten days, the US, Canada, and various stakeholders have floated the idea of a “skinny NAFTA”, relying on only the US Executive Branch (and not Congress) to “tweak” the NAFTA. The purest form of the “skinny NAFTA” would be to have updated auto ROO provisions and a few other “fresh coat of paint” upgrades in areas such as anti-corruption. More legally tenuous is to move the “skinny NAFTA” to a “fast NAFTA” which would have provisions on digital, customs and trade facilitation, as well as “quick-hits on dairy and other issues. There has been significant push-back from Congress, including from the chairman of the influential House Ways and Means Committee, as well as labor, on the “skinny NAFTA” option. While “skinny NAFTA” has some surface appeal as it would minimize any potential harm from the negotiations, the fall-out could bring the NAFTA closer to withdrawal. In short, faced with pushback that he is soft on NAFTA, the President will overreact. Dickinson Wright’s view is that the parties will proceed for a full NAFTA, which will take time to resolve major outstanding issues such as auto ROO, government procurement, supply management, dispute resolution, textiles, and intellectual property rights. Unfortunately, the parties are out of time under various domestic processes to reach a deal and submit for ratification by the close of 2018. There will not be a fully ratified NAFTANEXT in 2018.

4.China—Negotiations between the US and China will continue, with Secretary Ross visiting China in the coming weeks. China is starting to announce reductions in tariffs such as a new 15% auto tariff (down from 25%) and promotion of purchasing US goods. Pushback to the President’s efforts has been severe, with the US Senate passing a bill preventing the implementation of one deal element (easing trade remedies on China’s ZTE) and labor vocally challenging the President’s commitment to “get tough” on China. The politics of 2018 and 2020 will be determined by how the President handles China. Success could bring victory. Pushback, or allegations of the President easing up on China, could encourage wild extremes of actions and policies. 5.Trade Promotion Authority 2015 Extension—All of this activity is occurring against the backdrop of the President’s Trade Promotion Authority (TPA aka “fast track”) expiring on . While TPA has no role in Section 232 tariffs, it is the primary authority through which the President is negotiating the NAFTA and potentially will deal with UK, Japan and others. Pursuant to the statute, the President requested an extension of TPA until 2021. While Congress is not required to affirmatively approve the extension, Congress may file a “disapproval resolution” of the request. Up until this week, conventional wisdom was that the extension would smoothly sail through Congress; however, Congress may use June to “flex its muscles on trade.” A report on the extension is due from the International Trade Commission by . It may be worth a read and TPA extension may become the talk of June Dickinson Wright is engaged in all of these activities. We are happy to discuss and assist at any time. Best, Dan Daniel D. Ujczo Practice Group Chair - Intl & Regional Practices House Speaker Paul Ryan's May 17th deadline has come and gone without a new deal on NAFTA. This was originally the deadline for the Trump administration to submit a trade deal in order to have it voted on by the current congress before the end of the session.. This makes a NAFTA deal in 2019 now more likely than ever.

However, Canada and Mexico are not deterred by Ryan's deadline and remain optimistic about reaching a deal soon. Mexican Economy Minister Ildefonso Guajardo has said a deal in late May or early June is still possible (Mexico elects a new president on July 1st). In addition, on Thursday Ryan extended his deadline, saying that a deal produced in the next week or two could still be voted on by this congress. That would only be possible if the International Trade Commission can finish their review of the deal in less than the allotted 105 days after signing. Issues that still need to be solved: Auto manufacturing rules of origin, steel and aluminum tariffs, the dispute resolution mechanism, the sunset clause, seasonality tariffs, textiles, dairy market access, de minimis and ecommerce rules. If the parties cannot agree on a deal before these deadlines, an agreement in principle that would calm markets and lay a groundwork for next year is more likely. In late April PNWER issued a revised statement calling for a continued exemption of steel and aluminum tariffs from Canada which was extended another month. PNWER also issued a statement opposing tariffs on newsprint from Canada. In Other NAFTA News: Saskatchewan Premier Moe says NAFTA needs an update not a rewrite following first U.S. summit - Global News Christopher Sands on The Risks of Missing the May Deadline for NAFTA 2.0 - CSIS A new NAFTA will probably not get done this year. Now what? - POLITICO Trump’s Goal for Nafta Rewrite Looks Unattainable in 2018 - The Wall Street Journal Time is running out on NAFTA, as U.S. grapples with China over trade - CBS News Kudlow Says Nafta Deal Is Test of Trump Trade Cooperation - Bloomberg Contributions by Zack Tarhouni, PNWER Intern Christoper Sands, Senior Associate, Americas Program at the Center for Strategic and International Studies reviews the consequences of delaying NAFTA agreement at https://www.csis.org/analysis/risks-missing-may-deadline-nafta-20

An 'agreement in principle' could not be reached at the Summit of the Americas earlier this month, but Vice President Pence and Commerce Secretary Wilbur Ross, who attended in place of President Trump, are hopeful about reaching a preliminary deal by the third week of May.

All parties seem eager to meet this deadline as US Trade Representative Robert Lighthizer meets with his Canadian and Mexican counter parts on Tuesday (4/24) in Washington DC. High ranking officials met Friday (4/20) and will continue through the weekend in preparation for the trilateral meeting. The 7th of 30 eventual chapters in the NAFTA agreement has just been completed. The origin rules for auto parts remains a major sticking point in negotiations. This rule governs the percentage of vehicle content that must be made in NAFTA countries. Originally, the Trump administration wanted to raise that requirement from 62.5% to 85% and increase the amount built in the US but has 'significantly softened' their position. Former Commerce Secretary Carlos Gutierezz offered his predictions on an eventual NAFTA deal, saying that number will end up at 70%-75% for regional rules of origin (auto content coming from any of the three NAFTA nations rather than from US only). In addition, the proposed sunset provision requiring NAFTA renegotiation every five years will likely be changed to a recurring check-in. Other negotiation speed bumps include government procurement, investor-state dispute settlement (ISDS), and dairy products. Meanwhile, elections that could be consequential for NAFTA are quickly approaching; Mexico elects a new president on July 1, and US Midterm elections on November 6 could elect a Congress that makes NAFTA renegotiation difficult. Under the Trade Promotion Authority the White House must give Congress 90 days notice of its decision to sign the new agreement. 60 days before signing, a legal text of the agreement must be released (if anti-dumping and countervailing duty measures are changed by the deal, 180 days notice would be required instead). Other NAFTA and Trade news: https://www.forbes.com/sites/phillevy/2018/04/17/is-there-still-time-for-a-nafta-deal/#1dd7ae8f3122 https://www.politico.com/story/2018/04/20/lighthizer-nafta-trump-trade-congress-539248 Contributions by Zack Tarhouni, PNWER Intern |

Archives

August 2023

Topics

All

|

|

World Trade Center West

2200 Alaskan Way, Suite 460 Seattle, WA 98121 |

|