|

By Kai Guo, CFA, Vice President, Hydrogen Infrastructure Development - West Region at Mitsubishi Power This article is a submission from PNWER Sponsor, Mitsubishi Power Americas, and does not necessarily reflect the views of PNWER. Learn more about Mitsubishi Power Americas at power.mhi.com/regions/amer/products/hydrogen. A newly streamlined process for claiming tax credits under the Inflation Reduction Act (IRA) represents the next important stage of realizing the law’s impact. The process could bring affordable clean hydrogen production and storage projects to exciting new frontiers. With new players come new possibilities for hydrogen as a foundational element to the portfolio mindset we’ll need to reach zero-emissions energy. This shift also reinforces the need for cross-sector thinking – to enable stakeholders in adjacent industries to build off each other’s innovations and optimize demand, adopt used fuels for second-life applications, seek permitting reform, and more. When I spoke last week at the annual Pacific NorthWest Economic Region (PNWER) summit in Boise, Idaho, it was clear that collaboration remains essential to solving the climate crisis. Beyond unlocking innovation, it represents a promising opportunity to make these innovations more affordable. And that’s a critical step to moving the world off its current portfolio of transportation, industrial, and energy fuels, where fossil fuels still drove an estimated 81% of global energy consumption in 2022. If that percentage is disheartening, realize that we’re also making progress. Recently, a new projection of U.S. greenhouse-gas emissions by the Rhodium Group found a “meaningful departure” from previous forecasts, thanks to the IRA, to put U.S. targets for 2030 under the Paris Agreement within reach. I find that galvanizing – and I know that if we can break down our silos, we stand at the precipice of tremendous opportunity. Humanity has never lacked innovation. At PNWER, I saw it on display. Panelists discussed demand-side management projects that incentivize EV drivers to charge during off-peak hours. They made the case for faster permitting. They detailed new usages for spent nuclear fuel, off-gassed methane, and post-pyrolysis carbon. Indeed, a portfolio approach to energy production, consumption, and infrastructure requires more cross-sectoral analysis. As fellow panelist Shannon Bragg-Sitton put it, we need a “better understanding [of] how we can use energy from one sector to benefit another.” I couldn’t agree more. From left: Dave Bennett, Director, Renewable Gas and Low Carbon Fuels, FortisBC; Shannon Bragg-Sitton, Division Director, Integrated Energy & Storage Systems, Idaho National Laboratory; Jeff Morris, Senior Director, State Government Relations, Schneider Electric North America; Kai Guo, Vice President, Hydrogen Infrastructure Development, Mitsubishi Power Americas; and Senator Matt Boehnke, Washington State Senate. Public Investment Helps the First Movers The clean-hydrogen economy is still in the early innings, and public funding can help the first movers. Starting in 2021, the Department of Energy launched a series of large-scale energy investments it calls “earthshots,” a riff on moonshots. It’s a good way to disburse the $9.5 billion in clean-hydrogen initiatives from the bipartisan Infrastructure Investment and Jobs Act (IIJA). A year later, the IIJA helped fund Regional Clean Hydrogen Hubs program (H2Hubs), which allocates up to $7 billion for 6 to 10 clean hydrogen hubs across America. The program is progressing, with awards expected to come by year’s end and funding to commence in early 2024. Commitments like these demonstrate how investment from the public sector has helped first movers in hydrogen scale-up technologies at a rate that may not have happened with private capital alone. Even before the IIJA, public investment has borne fruit. Mitsubishi Power and Magnum Development jointly developed the Advanced Clean Energy Storage hub. Currently under construction in Utah, the project is one of the largest renewable-energy storage hubs in North America to reach financial close. And it’s in big part thanks to a $504.4 million DOE loan guarantee secured in 2022. The ACES Delta hub is one of the largest sites yet for hydrogen production and storage, in this case for the IPP Renewed project from Utah’s Intermountain Power Agency. The ACES Delta hub will use electrolysis powered by renewable energy to generate hydrogen, storing it in underground salt caverns and eventually using it to fuel electricity-generating turbines at the IPP Renewed power plant. That’s an example of the collaboration we need – with permitting and cross-sector innovation – to bring clean hydrogen closer to end users, eventually including hard-to-abate industrial and transportation sectors. Mitsubishi Power is bringing that innovation to remote parts of the continent, like British Columbia’s Kerry Lake East Indian Reserve. Working with the local tribe to provide jobs and sustainable revenue, Mitsubishi Power will use the proposed $5 billion hub to produce hydrogen and ammonia, another zero-emissions energy source. “We need to develop solutions together, to facilitate learnings. We can’t build these in silos.” We welcome the IRA’s streamlined credits to bring more players into clean hydrogen and related infrastructure. We need a combination of smaller-scale projects that sit closer to end users, large utility-grade projects, and infrastructure to transport the energy. Both will address the intermittencies associated with renewable power by spreading them across longer timeframes – to enable what my colleague Dr. Hari Gopalakrishnan, Market Intelligence and Strategy Manager at Mitsubishi Power, called “seasonal energy arbitrage” at last spring’s BloombergNEF Summit. Lowering Cost Is About Cooperation, Not Just Scale The portfolio approach to innovation can help lower prices, as can public capital and regulatory streamlining. I don’t know if enough stakeholders understand the critical need to lower costs as we build out technologies to enable more renewable supply. At PNWER, Emissions Reduction Alberta CEO Justin Riemer – whose province is phasing out coal emissions this year – put it well. “We’re taking a portfolio approach to generation and supply, what we need to get to net zero,” Riemer said. “Everything we’re talking about is expensive. Carbon capture, hydrogen, storage, the energy transition – it’s a lot more cost than we’ve seen in energy. We need to cooperate to reduce that. … We need to develop solutions together, to facilitate learnings. We can’t build these in silos.” The energy transition requires stakeholders to work across sectors to apply and scale solutions at a rapid pace. A portfolio approach requires breaking down silos to collaborate across supply, infrastructure, demand, and byproducts. Success means the cost of renewable, reliable energy will decrease, lifting viability and usage to levels that can put the world on an auspicious path to net zero.

0 Comments

PNWER kicked off 2023 with a return to in-person visits to our U.S. capitals. PNWER Delegations traveled to Helena, Montana; Olympia, Washington; Salem, Oregon; Juneau, Alaska; and Boise, Idaho throughout January.

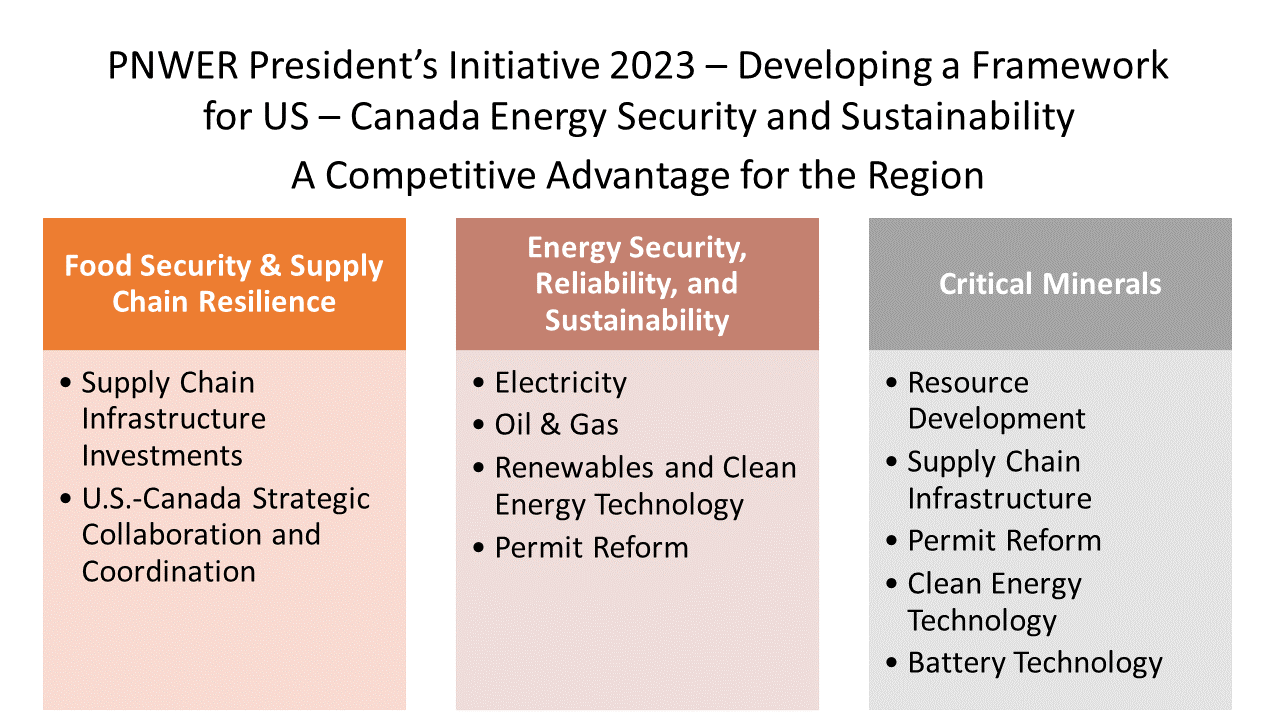

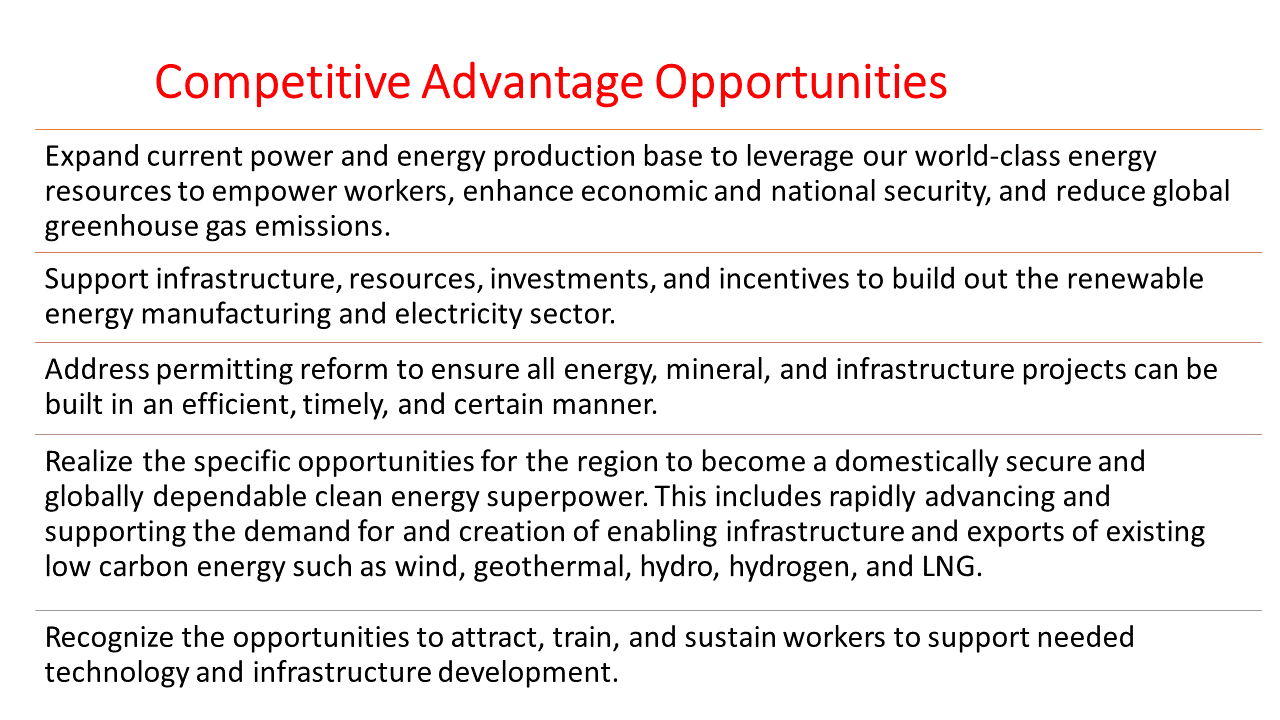

These annual capital visits allow PNWER delegates and stakeholders to meet with key government, legislative, and private sector leaders to discuss issues important to our region. Each year, PNWER Executive Committee Members and staff visit our region’s capitals to discuss regional issues and assess priorities that PNWER should focus on in the coming year. Meetings with legislative majority and minority leadership, governors and premiers, and key executive branch staff provide an opportunity to discuss regional trade and PNWER programs. The visits also allow for cross-border legislative collaboration and ongoing relationship building. Major themes this year included the PNWER President’s Initiative on developing a North American Energy Security & Sustainability Framework; the Electric Supercluster proposal with the Electrical Joint Training Committee with IBEW and SkillSource BC; the PNWER RIA; housing; energy policy; disaster resilience; and decarbonization. PNWER in Helena

A PNWER delegation traveled to Helena for a series of meetings at the Montana State Capitol. The delegation included PNWER President Senator Chuck Winder (ID); Senator Mike Cuffe (MT), Past PNWER President; Andrew Fisher, Director of U.S. West Coast for the Government of Alberta; Senator John Brenden, Montana Governor’s PNWER Representative; Matt Morrison; and Nate Weigel. In addition to building relationships with policymakers, the visit focused on identifying regional priorities for Montana and how PNWER could provide value to the state.

The visit kicked off with an evening dinner hosted by Senator Mike Cuffe with a number of Majority Caucus leadership including Senator Jason Ellsworth, Senate President; Senator Walt Sales, Senate Energy Chair; Representative Rhonda Knutson, Speaker Pro Tempore; Representative Sue Vinton, House Majority Leader; Senator Keith Regier, PNWER delegate; and Senator Doug Kary. Over the next two days, PNWER also met with Minority Caucus leadership including Senate Minority Leader Pat Flowers and House Minority Whip Katie Sullivan and discussed Montana priorities and delegate council appointments. The PNWER delegation was introduced during the Senate and House floor sessions. The delegation met with a number of committee chairs including separate meetings with Agriculture Committee Chairs Senator Mike Lang and Representative Josh Kassmier during which issues were discussed around Milk River and St. Mary’s irrigation and canola as a feedstock for renewable diesel. The delegation met with Energy Chairs Senator Walt Sales and Representative Katie Zolnikov to discuss Senator Winder’s presidential initiative around the development of a Food and Energy Security and Sustainability Framework. The Food and Energy Security and Sustainability Framework was positively received in all of the meetings and all were eager to provide input to its development. The delegation was able to hold a substantive meeting with Montana Livestock Director Mike Honeycutt and Assistant State Veterinarian Tahnee Szymanski. Topics of discussion included the upcoming Boise Summit and agriculture and livestock health issues including the need for continued advocacy for e-certification of livestock in border crossing, coordinated regional planning in the case of outbreak such as foot and mouth disease, feral swine, and best practices in poultry that can be applied to other species such as pork. The PNWER delegation held an evening dinner with Montana Department of Transportation Director Mack Long, his leadership team, and Representative Denley Loge, House Transportation Committee Chair. During the dinner, the PNWER delegation and guests talked extensively around expanding PNWER’s RIA program to Montana and how to assist rural and underserved Montana communities with infrastructure development and technical assistance.

PNWER also hosted a Legislative Pizza Lunch to share broadly PNWER’s initiatives and recruit legislators for the Legislative Energy Horizon Institute. This was widely attended by legislators.

PNWER presented before the Senate Natural Resources Committee, where the delegation was able to share about several PNWER initiatives, including the Energy and Security Framework, the opportunity for private sector funding through the Department of Defense for critical mineral development, and LEHI. In addition, PNWER gave an update on regional AIS funding to the committee and invited Thomas Woolf, AIS Bureau Chief at MT Fish, Wildlife, and Parks, to provide an extensive overview of Montana’s current AIS efforts and answer numerous questions from legislators around Montana's strategy to combat invasive mussels. PNWER also presented before the Senate Business, Labor, and Commerce Committee and provided updates on the aforementioned initiatives, as well as PNWER’s Regional Infrastructure Accelerator. The visit concluded with a meeting with Governor Greg Gianforte and his Natural Resources policy advisor Michael Freeman. Senator Winder shared his initiative with the Governor and received a promise of support. In addition to the aforementioned issues, the group also discussed the issue around maintaining longer border crossing hours for the important crossings located between the Montana-Saskatchewan border. Governor Gianforte will be traveling to Washington, D.C. to meet with members of the Executive Branch and the Congressional delegation and asked for regional priorities from PNWER that could be shared in these meetings. PNWER in Olympia

PNWER had a series of productive meetings over the course of the two-day visit. The meetings began with a presentation to the House Innovation, Community & Economic Development and Veterans Committee which PNWER U.S. Vice President Representative Cindy Ryu chairs. Matt Morrison, Brandon Hardenbrook, and Steve Myers presented on economic development and workforce opportunities related to Hydrogen and Electrification, the Center for Regional Disaster Resilience and the Pandemic Roadmap, and the PNWER Congregate program, in addition to providing a general overview of PNWER activities and inviting all members to attend the Annual Summit in Boise, Idaho.

The delegation received a warm welcome from all House members during an introduction on the House floor, which was followed by a series of beneficial one-on-one meetings with members of both the House and Senate.

During the meeting with PNWER delegate Senator Lisa Wellman, the Senator led an informative discussion on the multi-faceted considerations for developing housing legislation. PNWER met with Senate Majority Leader Senator Andy Billig, a graduate of one of the first LEHI cohorts, who enthusiastically agreed to continue to recruit for the program. Representative Joe Timmons, Chair of the Transportation Housing Committee, and Senator Joe Nguyen, Chair of the Senate Energy and Environment Committee, were both very eager to learn more about PNWER's Regional Infrastructure Accelerator (RIA) initiatives and offered recommendations to pursue additional funding opportunities to electrify port drayage trucks. Representative Timmons expressed interest in working with PNWER to continue to address border issues and work closely with partners in BC on addressing flood issues. PNWER had a lengthy meeting with Lieutenant Governor Denny Heck, who is very supportive and keenly interested in PNWER programs. He was particularly interested in the RIA program and PNWER's cross-border initiatives and would like to explore opportunities to work more closely with BC. The PNWER delegation also met with Governor Inslee’s Director of International Relations and Protocol, Geoff Potter, who provided details on some of the Governor’s initiatives and priorities for this legislative session.

Senator Bob Hasegawa offered helpful insights to the delegation as PNWER continues to develop and pursue funding for the Electrical Supercluster initiative. The delegation had a productive meeting onsite with the IBEW and SkillSource BC who, together with PNWER, are putting together details for a budget proviso.

PNWER also met with Representative Beth Doglio, Chair of the House Energy and Environment Committee, who was interested to learn more about LEHI and PNWER's efforts around electrification and decarbonization. Representative David Hackney is working his way through the LEHI program and is very eager to become more involved with PNWER. A highlight of the visit was a PNWER legislative reception in the Senate Rules room, welcomed by Lieutenant Governor Denny Heck. The delegation saw many familiar faces and also met with a number of legislators who were new to PNWER. This was a great opportunity to connect and share more about PNWER’s regional collaboration. Additional meetings included Representative Mary Dye, Ranking Minority Member of the House Environment and Energy Committee; PNWER Delegate Representative Bruce Chandler, Representative Cindy Ryu, and Senator Matt Boehnke. Thank you to Representative Ryu for the assistance organizing this productive visit. PNWER is looking forward to working with Representative Ryu during her presidency and a 2025 Annual Summit in Washington State. PNWER in Salem

A sizeable delegation representing PNWER traveled to Salem, Oregon, for a series of meetings with legislators and leadership. The discussions focused on several PNWER initiatives and programs including Senator Chuck Winder’s North American Energy and Food Security and Sustainability Initiative, Legislative Energy Horizon Institute (LEHI), the Center for Regional Disaster Resilience (CRDR), Aquatic Invasive Species, PNWER’s Regional Infrastructure Accelerator (RIA), high-performance rail, and regional electrification and decarbonization efforts, and housing and homelessness among other issues.

The PNWER delegation included PNWER President Senator Chuck Winder; PNWER U.S. Vice President Representative Cindy Ryu; Brandon Hardenbrook, PNWER COO; Tara Edens, PNWER Program Manager; Nathalie Beaudoin, Consulate General of Canada-Seattle; Dan Kirschner, Northwest Gas Association and PNWER U.S. Private Sector Co-Chair; Bruce Agnew, Director of PNWER’s Regional Infrastructure Accelerator; Jeff Morris, Schneider Electric (former WA Representative); and Natasha Jackson, Northwest Gas Association. The PNWER delegation kicked off the visit with a sit-down meeting with the Senate President Rob Wagner and the Senate President Pro Tem James Manning to give them an overview of PNWER and its initiatives. Senator Wagner was particularly interested in broadband and energy legislation and best practices from across the region. Senator Manning, a graduate of LEHI, spoke highly of the value of the program and recommended it for all legislators.

PNWER then met with PNWER Delegate Senator Bill Hansell to discuss initiatives including the RIA and his legislative priorities for the upcoming year which include water policy related to the Columbia River Treaty and the Snake River Dams.

Following that meeting, PNWER met with Representative Dacia Grayber, Chair of the House Committee on Emergency Management, General Government, and Veterans, and Representative Maxine Dexter, Chair of the House Committee on Housing and Homelessness, as well as Speaker of the House Representative Dan Rayfield’s staff to discuss the appointment of new PNWER delegates as well as LEHI recruitment. Later in the afternoon, PNWER spoke to Representative Ken Helm, Chair of the House Committee on Agriculture, Land Use, Natural Resources, and Water, who expressed interest in being a PNWER delegate and becoming more involved in PNWER initiatives. He is also a graduate of LEHI and spoke highly of the experience. PNWER also met separately with both Senator Chris Gorsek and Representative Nancy Nathanson to discuss PNWER’s RIA, high-performance rail, electrification, and public-private partnerships as well as transportation legislation that they are sponsoring. Both are members of the Oregon Rail Caucus and are enthusiastic about working with PNWER on transportation initiatives. Additional meetings were held with PNWER Lead Delegate Senator Lew Frederick; Senator Jeff Golden, Chair of the Senate Committee on Natural Resources; PNWER Delegate Senator David Brock Smith (newly appointed to the Senate from the House); Representative Virgle Osborne; and Molly Woon, Elections Division Director for the Secretary of State’s Office. Legislators and staff were encouraged to join PNWER in Boise, Idaho on July 16-20 for PNWER’s Annual Summit with many legislators indicating a desire to attend. PNWER in Juneau Matt Morrison with Sen. Lyman Hoffman Matt Morrison with Sen. Lyman Hoffman

PNWER had a tremendous capital visit with a number of Alaska legislators and the Lieutenant Governor. PNWER Executive Director Matt Morrison and Senior Program Manager Steve Myers had individual meetings with Lieutenant Governor Nancy Dahlstrom and eighteen House and Senate Members. Matt and Steve also met with staff from the Departments of Transportation and Economic Development.

Meetings were held with Speaker of the House Cathy Tilton and Senate President Gary Stevens about the importance of PNWER to Alaska and selection of new delegates to the PNWER Board. PNWER had the opportunity to showcase new initiatives underway for 2023 and highlight the upcoming Summit in Boise, Idaho on July 16-20. PNWER was invited to present to the Alaska House Energy Committee on a couple initiatives that are important to the State. The Committee is chaired by LEHI Alumni Rep. George Rauscher and includes recent graduate Rep. Calvin Schrage, House Minority Leader. The LEHI program has given legislators an opportunity to get versed in the upstream and downstream world of energy. The committee also learned about the PNWER President's initiative focusing on Food Security & Supply Chain Resiliency; Energy Security, Reliability, & Sustainability; and Critical Minerals. The committee hearings and the individual meetings with the Lieutenant Governor; House and Senate Members along with staff are invaluable to showcasing the work PNWER does.

PNWER's Presentation begins around 45:20.

PNWER in Boise

Last, but certainly not least, PNWER's visit to Boise was a major success - paving the way for a robust and well-attended PNWER Annual Summit in Boise July 16 - 20, 2023. Beyond the upcoming Annual Summit, discussions focused on reinvigorating the PNWER Idaho Council; Senator Winder’s Presidential Initiative on North American Energy, Food Security, and Sustainability; Legislative Energy Horizon Institute (LEHI); Center for Regional Disaster Resilience (CRDR); Aquatic Invasive Species; Feral Swine; PNWER’s Regional Infrastructure Accelerator (RIA); high performance rail; and the return on investment Idaho receives from its annual investment in PNWER.

The PNWER delegation included PNWER President Sen. Chuck Winder; Matt Morrison, PNWER CEO; Brandon Hardenbrook, PNWER COO; Bruce Agnew, Director of the RIA program; Betz Mayer, Assistant Director of the RIA program; and Megan Graves, Consulate General of Canada-Seattle. Meetings were coordinated by PNWER Idaho Coordinator Gloria Totoricagüena. PNWER kicked off the two day visit by meeting with recently-elected Lt. Governor Scott Bedke, formerly of the Idaho House of Representatives. He takes the mantle as Chair of the PNWER Idaho Council, a unique Idaho-specific structure that brings together the public and private sector leaders within Idaho to discuss key regionally significant issues and promote the work of PNWER in the state. The PNWER Idaho Council was established by now-Governor Brad Little when he was Lt. Governor in the 2010s.

Governor Brad Little met with the PNWER delegation immediately afterwards, where he emphasized permitting as a major obstacle to Sen. Winder’s Presidential Initiative. He noted that “we’ve got to get permits out faster” if the U.S. wants to meet our critical mineral production goals and decarbonize our transportation sector. Because permits and studies must be done by several U.S. agencies, all with different deadlines and schedules, starting a new project often involves millions of dollars spent on permitting before anyone can break ground. Gov. Little noted that this would be a good issue for PNWER and the Congressional delegation to focus on, specifically trying to understand how the permitting process can be better coordinated across agencies and executed more efficiently without altering the sentiment of the studies required.

Megan Graves from the Consulate General of Canada-Seattle highlighted Alberta’s 7 day permitting process for certain projects, and Canada’s overall more streamlined approach to permitting. This was very interesting to Idaho’s public and private sector representatives. [Citing Governor Spencer Cox of Utah, Governor Little noted that “we don’t need money, we need a permit,” underlining the frustration from the state and private sector at the complications and time delays associated with any new projects.]  PNWER presents to the Senate Transportation Committee PNWER presents to the Senate Transportation Committee

PNWER Idaho Council hosted a lunch for Council members, which included an informational session on PNWER and our work, a brief history of the PNWER Idaho Council and what they do, and a robust discussion about the issues and topics they want to see at the PNWER Annual Summit this summer. Permit reform, energy generation and distribution, transition planning for a net zero future, workforce shortages, housing, pressure on food systems, invasive species, and the Columbia River Treaty were all key issues.

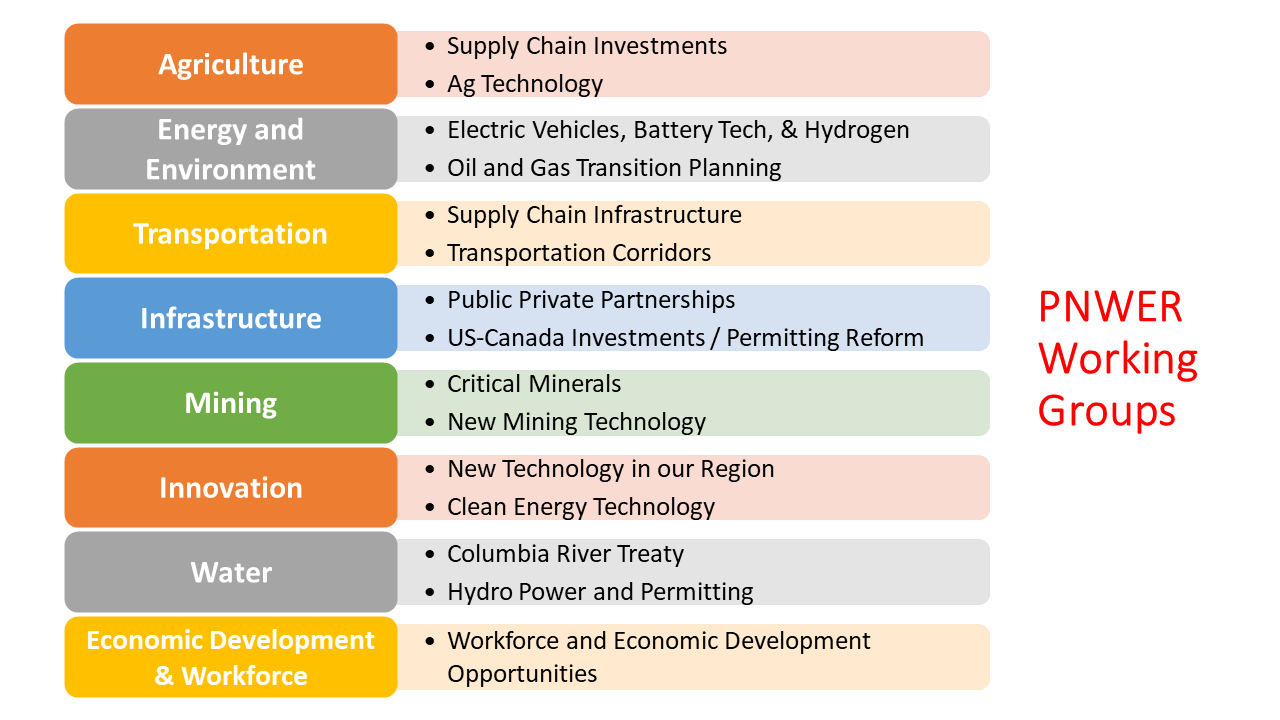

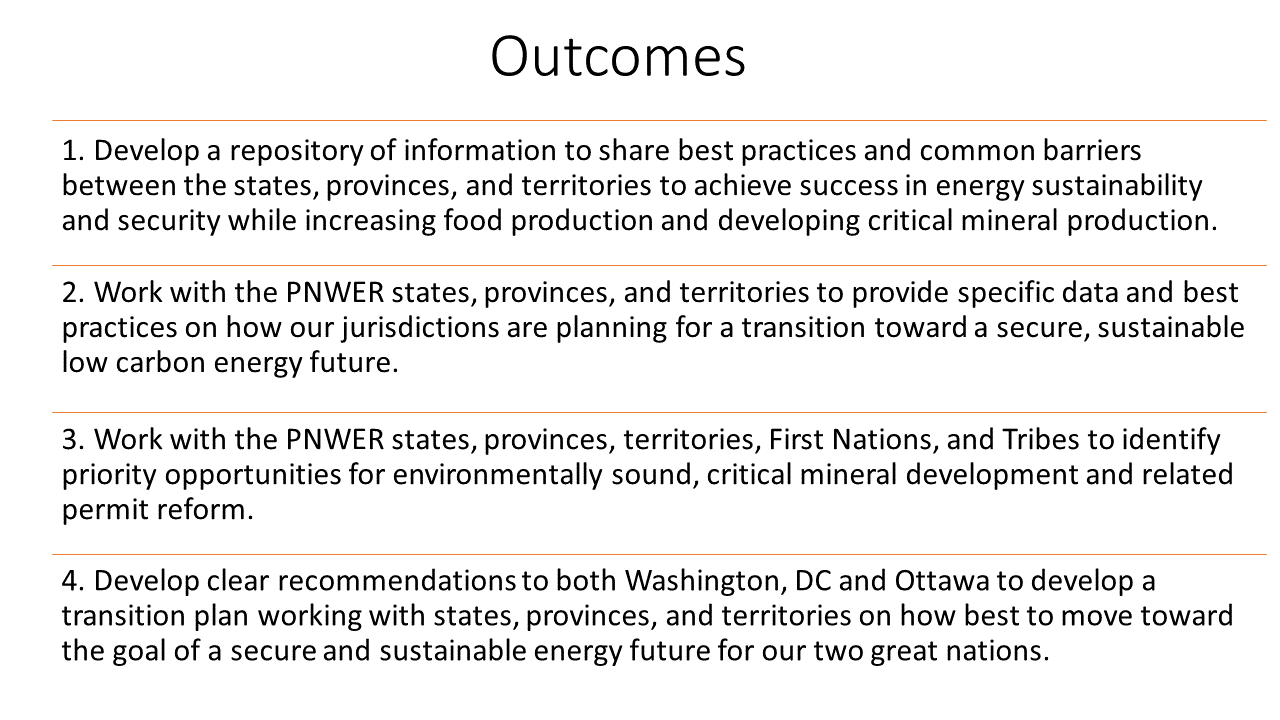

Sen. Winder, Matt, and Brandon gave presentations at the House Agricultural Affairs Committee and the House Environment, Energy, and Technology Committee. Sen. Winder provided an excellent overview of his Presidential Initiative for both Committees, and there was overall high levels of interest in how this initiative intersects with the agriculture and energy sectors within Idaho. Betz met with Bre Brush from the Boise Mayor’s Office to continue collaboration efforts between the PNWER RIA and Greater Northwest Passenger Rail Forum, which will include some joint programming on Wednesday, July 19 during the PNWER Annual Summit. Bruce met with Elaine Clegg, CEO of Valley Regional Transit, and Bill Conners, CEO of the Boise Metro Chamber, to discuss trains and transit in the Treasure Valley. Bill Conners also joined PNWER for our prospective sponsorship dinner, and gave us a great shout-out in his weekly newsletter! On day two, PNWER met separately with Sen. Mark Harris, Senate Majority Caucus Chair, Speaker of the House Rep. Mike Moyle, House Energy Committee Chair Rep. Vito Barbieri, and PNWER delegate Rep. Charlie Shepherd, discussing PNWER programs and the return on investment Idaho receives from its dues to PNWER, which are more than tenfold over the past 30 years. The PNWER delegation was introduced to the House and the Senate, before Bruce, Betz, and Matt gave a presentation to the Senate Transportation Committee on the RIA and what it can do for Idaho. This was on the heels of some very successful one-on-one meetings with Mollie McCarty, Chief External Affairs Officer at Idaho Department of Transportation (IDT); Scott Leukenga, Freight Program Manager at IDT; and Laila Kral, Administrator of Idaho’s Local Highway Technical Assistance Council (LHTAC). The PNWER RIA looks forward to partnering with the LHTAC and IDT moving forward. Legislators and staff were encouraged to join PNWER in Boise, Idaho on July 16-20 for PNWER’s Annual Summit with many legislators indicating a desire to attend. PNWER President Sen. Chuck Winder's Presidential Initiative to Focus on Food Security & Supply Chain Resiliency; Energy Security, Reliability, & Sustainability; and Critical Minerals At PNWER's 2022 Economic Leadership Forum in Portland, Oregon on December 6, PNWER President Senator Chuck Winder of Idaho announced his presidential initiative focusing on Food Security & Supply Chain Resiliency; Energy Security, Reliability, & Sustainability; and Critical Minerals. Watch the full session here, or view the overview slides. More info to come!  Photo by Tom Fisk Photo by Tom Fisk At the recent Pacific North-West Economic Region (PNWER) Annual Summit, over 600 elected officials, government and private sector leaders from Canada and the United States gathered to discuss the most important issues impacting our cross border regional economy. Agriculture leaders on both sides of the border highlighted the importance of agricultural trade to our region’s health, security, and enhancement of our shared economy. Our cross-border integrated agriculture supply chains are vital to the region’s competitiveness internationally. These interdependent cross border connections allow producers to feed North America and the world. However, Ag supply chains are highly dependent on aging critical transportation infrastructure that must be upgraded to sustain and expand economic growth and enhance community resilience. Canada and the US are engaged in parallel initiatives to improve supply chains and transportation infrastructure in their respective countries, but have few avenues for strategic collaboration. Canada established a Supply Chain Task Force to provide recommendations for improving supply chains, and will fund infrastructure projects through its National Trade Corridor Fund. The US established a Supply Chain Disruptions Task Force to address bottlenecks, and will use programs like the Port Infrastructure Development Program to invest in much-needed infrastructure. We see an important strategic opportunity for Canada and the US to greatly enhance their respective investment efforts by collaborating as bi-national partners, promoting participation and input from each other. Collaboration and dialogue on strategic supply chain infrastructure investments is a win for our region and North American Agriculture exports. As co-chairs of the PNWER Agriculture Working Group, we urge both the U.S. and Canadian federal, state/provincial, and local governments, as well as our essential private sector partners to work together to plan and implement strategic investments in modernizing critical supply chain infrastructure to enhance the competitiveness of the cross border region. These coordinated strategic investments will result in shared economic growth, and new business opportunities with more and better jobs for all. PNWER Agriculture Working Group Co-chairs & Staff:

The Pacific NorthWest Economic Region is a statutory public/private nonprofit chartered in 1991 by the states of Alaska, Idaho, Oregon, Montana and Washington, the Canadian provinces of British Columbia, Alberta, Saskatchewan, Yukon and Northwest Territories. The opinions and thoughts expressed are those of the authors. Today, PNWER is thrilled to announce the founders and companies selected for the Congregate Solutions Accelerator Second Cohort. These companies were selected to participate because their ventures align with Congregate’s mission to accelerate resilience in travel and tourism. Over the course of the next ten weeks, these founders will work with Congregate to secure partnerships with travel and tourism companies throughout the northwest to test out concepts that can help the industry around these lingering challenges: (1) workforce and labor challenges and (2) the lagging recovery in business travel. On May 11 at 2pm PT, the founders of Cohort Two will have their first chance to “pitch for partners” in an event designed to connect them with partners to work on specific projects. Companies interested in meeting directly with these founders to discuss their product or attending the event on May 11 should reach out to congregate@pnwer.org for more information. Read the full Cohort Two news release below. SEATTLE, May 3, 2022– The Pacific NorthWest Economic Region (PNWER) has selected nine tech startups from across the United States for the second cohort of its Congregate Solutions Accelerator. The Congregate Accelerator brings tech startups together with experts from industry and government to solve challenges in the Tourism, Performing Arts, Travel, and Hospitality (TPATH) industries.

Founders are offered a multitude of opportunities including one-on-one mentorship, access to thousands of dollars in credits from Amazon Web Services, market research, and the opportunity to access new customers in the travel and hospitality sectors. The Accelerator program will include 10 weeks of curriculum focused on the needs of startups at this phase in their journey anchored in the network and partnership with the Washington Technology Industry Association. Each founder will work with their mentors and Congregate staff to pursue opportunities for pilot projects with the program’s industry partners - organizations ranging from the Seahawks to Argosy Cruises to small business owners, and event venues. Companies selected for Cohort Two include: CityGuyd Naor Amir and Pauline Feder, Co-Founders CityGuyd turns real life people into digital, Augmented Reality tour guides! Our digital guides or famous VIPs can be found at cities, landmarks, & events across the globe - improving the travel experience, increasing fan engagement, and providing our clients with valuable data on their visitors! ClubHealth Daniel Bolus and Josh Lim, Co-Founders ClubHealth is a one-stop platform for modern employee health perks. We curate and bundle personalized, subclinical health & wellness products for employees based on individualized profiles that can be deployed in any work environment. Products include premium fitness and mental health apps, nutritional supplements, subscription boxes, educational resources, and more. Edizeven Shilpi Gupta, Founder Edizeven is a jobs website built from the ground-up for the special needs of the restaurant and hospitality industry. Whether you work in a restaurant or you run one, time is scarce. Edizeven provides tech-powered, personalized hiring solutions for restaurants, helping them hire staff 3x faster and better. Kickback Space Inc Rocco Haro, Founder Introducing the best way to come together online: kick back, a more human video conferencing experience. Our custom video network introduces superior enhancements to make communicating online feel like we are actually together. LegUp Jessica Eggert, Founder Families need child care to cover the hours they're at work, but the process to find a quality, full-time care can take months or even years. We're building technology that helps working families find care when and where they need it, so they can get back to everything else. LocalBuzz, Inc. Adrian Gillette and Tony Ce, Co-Founders LocalBuzz makes it so much easier for people to venture out into their local communities, find interesting things to do, meet people in real life, and be social. We provide an exciting way to explore your town, city, and community by discovering local spots and things to do through videos. It’s the best way to find a new restaurant, a great new band to see, or an experience to share. Save new discoveries, capture the moment and share your experiences. It’s time to break out of our bubbles and find new things that make our lives a lot happier! Motis Inc. Richard Beaton, Founder Motis Grow offers companies a way to make the employee experience fair and personal with customizable career paths, skillsets, and feedback. Employees love Motis Grow because it makes them feel known, like they belong and have a future with the company. And it fosters career growth, employee retention, and overall high performance, which are good for business. Radious Amina Moreau, Brian Hendrickson & iLan Epstein, Co-founders Radious offers companies a marketplace for on-demand meeting spaces and private offices right in their employees' neighborhoods. The model is similar to Airbnb but instead of overnight accommodations, we offer great workspaces — close to home. Companies love Radious because our spaces allow for in-person collaboration without forcing teams to commute back to a centrally located office. They offer better work-life separation by getting people out of the house, shorten commute times, reduce turnover costs by offering teams flexibility, and are cheaper than that rigid 10-year lease that companies were previously constrained by. Simply X Christopher Davies & Emily Cheng, Co-Founders SimplyX provides a cloud-based platform for our customers where they can easily create and manage mobile-friendly mini-webpages within minutes. Through our Design Studio, important business links can be aggregated into effective customizable campaigns. Once created the system also generates URLs and downloadable QR and NFC files, that allow these campaigns to be shared through endless channels as well as everyday items. By their digital assets to physical items like product packaging and branded merchandise, ordinary items become dynamic marketing assets that people can engage with in the real world, extending their digital voice outside of the internet. More information about the Congregate Accelerator Program can be found at www.congregate.resiliencefoundry.org. ABOUT CONGREGATE Congregate is a challenge-based solution accelerator program run by the Pacific Northwest Economic Region (PNWER) as part of its Resilience Foundry initiative to build strong and resilient new economies in the Pacific Northwest. The Accelerator brings industry experts from the tourism, performing arts, travel, and hospitality (TPATH) sectors together with industry experts to support and partner with innovative startup companies with capabilities to help reopen these sectors quickly and safely. The program is funded by the SPRINT Challenge, a grant program of the U.S Economic Development Administration. PNWER along with their partners at the Washington Information Technology Association, Alaska Travel Industry Association, and Future Borders Coalition have implemented an accelerator that connects the Northwest innovation economy to the TPATH industries. ABOUT PNWER The Pacific NorthWest Economic Region (PNWER) is a public/private non-profit organization created by statute in 1991. Member jurisdictions include Alaska, Idaho, Oregon, Montana, and Washington, and the Canadian provinces and territories of Alberta, British Columbia, Saskatchewan, the Northwest Territories, and Yukon. PNWER's mission is to increase the economic well-being and quality of life for all citizens of the region, identify and promote "models of success, and serve as a conduit to exchange information. PNWER is a registered nonprofit in the state of Washington and will not receive equity in any of the startups that participate in the Congregate program. ABOUT SPRINT GRANT The Congregate Solutions Accelerator is funded by the Scaling Pandemic Resilience through Innovation and Technology (SPRINT) Challenge Grant, which was awarded to PNWER by the U.S. Department of Commerce Economic Development Administration. ### The Pacific NorthWest Economic Region (PNWER) has a 30-year history of working with public and private sector stakeholders in the Pacific Northwest to find regional solutions to cross border challenges. PNWER facilitates cross-border collaboration and communication on a variety of issues impacting the economy through its 20 working groups, focused on the key economic sectors of the region. PNWER was chartered in 1991 by the legislatures of Alaska, Idaho, Montana, Oregon, Washington, Alberta, British Columbia, Northwest Territories, Saskatchewan, and the Yukon, and is the only statutory cross-border organization with a mission to address U.S.-Canada economic issues. The following recommendations were developed in collaboration with PNWER executive committee members, key stakeholders, and input from our 20 working groups. RecommendationsTrade and Regulatory Cooperation

U.S. Department of Commerce; U.S. Treasury Department

COVID Recovery and Supply Chain Resilience U.S. Department of Commerce

Safely Reopening the Border U.S. Department of Homeland Security

Border Technology U.S. Department of Homeland Security

Preclearance U.S. Department of Homeland Security

Columbia River Treaty U.S. Department of State

Bi-National Energy Policy U.S. Department of Energy

Cross-Border Infrastructure U.S. Department of Transportation

Aquatic Invasive Species U.S. Army Corps of Engineers

Disaster Resilience U.S. Department of Homeland Security

Forestry U.S. Department of Interior; U.S. Forest Service

Arctic Policy U.S. Department of Interior; U.S. Department of Defense; U.S. Department of Commerce

Mining U.S. Department of Commerce

This article was authored by PNWER Innovation co-chair, Nirav Desai, CEO of Moonbeam Exchange, and was originally published as op-ed in Medium. You can fit more than 40 Bends or 120 Walla Wallas in metro Seattle, and still have room for a few more Starbucks. Named after the Farewell Bend in the Deschutes River, tech workers and executives have been making the delighted acquaintance of outdoor sports and craft-beer utopia Bend for several years. Nestled between the Cascade Mountains and the high desert, Bend is a summer and winter sports destination. It is also home to some of the best-known craft breweries in the region, including Deschutes, 10 Barrel, and Crux. The quality of life in Bend helps explain why its remote workforce also grew 23% between 2013 and 2015. (Source: Bend Bulletin) Walla Walla began its life known as Nez Perce, so named for the fort built there to establish trade relations with the local indigenous group of that name. Since then, the eponymous county seat (which changed its name when the fort did, to the indigenous phrase “place of many waters”) was reborn again and again, from a missionary college to a fur trading hub for Hudson Bay, to an Army fort again, to a Gold Rush town, and for about a century after, an agricultural center of south-eastern Washington. If you drive in, your first sights of the city limits will show you those agricultural foundations remain intact, but at least as often as wheat or Walla Walla sweet onions (the state’s official veggie), you’ll see sprawling, scenic wineries, whose Merlots, Cabs, and Syrahs flourish in the region’s Mediterranean climate. With these wineries come the attendant businesses: high-end restaurants, luxury hotels, and festivals.  Walla Walla at sunset (Photo courtesy Visit Walla Walla) Walla Walla at sunset (Photo courtesy Visit Walla Walla) Look closely, and you’ll see that none of this rural luxe is bolted ad hoc onto the gentrified quarter of an otherwise sullen community of less-fortunate townies. The vineyards, craft breweries (wheat remains an important staple), and restaurants harness local skill sets that were already there, honed by over a century. The elegant Marcus Whitman hotel, boasting tech-enabled conference centers and plush meeting rooms, is a rehabilitated local landmark nearly a century old. This booming local hospitality and service industry in both towns wouldn’t exist without standing demand. Between four to six hours from both Portland and Seattle, they are a driveable weekend destination, but what’s made Bend and Walla Walla Cinderella stories rather than a boom town flash in the pan is their ability to strategically innovate and attract talent. They have found a way to attract a unique brand of tech commuters: tech elites empowered by the ongoing remote-work revolution to trade 10th floor office window views of 1st Ave for home offices close to hiking and mountain biking destinations. None of this was an accident. Rather, it is a testament to smart regional economic development. The success of certain north-western small and medium cities like Walla Walla and Bend are creating a model for sustainable small towns that has fertile ground across the region and the nation. The COVID-19 pandemic lit a fire under the telework movement- 77% of human resources executives expect the trend toward remote work to continue, even one year after COVID-19 substantially subsides. (Source: Conference Board 2020 survey) The sprouts of economic recovery before the large-scale reopening of the country has even begun demonstrates, in part, that productive remote work has found its footing: companies able to maintain a remote workforce have found overwhelmingly that productivity has been maintained or increased, coupled with the obvious massive savings in costs of facilities, travel, and centralized infrastructure. When you can work anywhere, sooner or later you’ll probably ask yourself, “do I have to live in a dense technology center just to do my job?” Now that it’s been proven possible, demand for alternatives to dense urban lifestyles for skilled technology sector workers has hatched, and it’s only going to grow. Communities just need to show up. Not A Bedroom Community — A Fully-Integrated Local Economy Walla Walla’s was powered by calculated moves made by the local government. Harnessing the skills and assets of the existing population and localities included pivoting- not replacing- to adjacent value creation. Their community college invested heavily in leveraging a long-standing, quality agricultural sciences program to quickly develop local viniculture talent, creating a standing workforce ready to put existing farmland and infrastructure to work. Surrounding commercial zones (extant or created) transitioned to upscale dining and retail collateral to the wine boom; demand for hospitality followed naturally. Bend has been marketing its quality of life for remote workers for years citing high profile profiles of commuting and remote working tech executives. According to the U.S. Census in 2015, 9.3% of Bend workers are remote workers. (Source: Bend Bulletin)  Mount Bachelor outside of Bend, OR Mount Bachelor outside of Bend, OR The planned revitalization and growth into a lifestyle city holds balance at its core. This isn’t about building an amusement park and resort in the middle of a desert; existing, localized value, skills, and labor are the starting point. When Amazon built its Seattle headquarters, for example, a condition of their agreement with the city was that the campus would not include a cafeteria and similar support facilities- employees would need to engage the surrounding communities for places to eat, gather, do laundry, get healthcare, and so on. For a second or third-tier city to plan its evolution into a lifestyle city, this sort of social contract is even more important, because there won’t be facilities popping up downtown, built by the employers of your incoming tech elite. You’ll need to grow your own- and the potential upside to your local population is far, far greater than becoming a company or campus town. Where Can Cities Start? While every city heading down this evolutionary path brings unique value to the table, there are fundamentals every planning committee should begin with. A solid, complete coverage of high-quality broadband is an absolute necessity, and the very first thing any municipality should prepare if they want to benefit from remote working trends. For many rural communities who aren’t already in this position, it’s the most daunting- but there’s a wealth of resources for clearing this hurdle. The Rural Economic Development Innovation (REDI) Initiative (for communities of 50,000 or less), Telecommunications Infrastructure loans and loan guarantees, and Strategic Economic And Community Development funding are all offered by the US Department of Agriculture for rural communities taking steps to develop infrastructure- and there are numerous grants within, and beyond, these programs. Consider enlisting the services of an agency that can help you gather and analyse data on value in your region- what do you have? what do you want to attract? How to partner with other innovators? and the expertise to benefit from other investments and compete globally.[2] The post-COVID business landscape holds the seeds of a renaissance in the relationship between work and location, and unprecedented opportunity exists for communities able to offer unique, distinctive character beyond the urban landscape. The development of lifestyle cities allow small towns the opportunity to create sustainable growth, retain their character, and honor their history while building a future. Takeaways — The acceleration of transition to full-time remote work has created an unprecedented opportunity for small cities in the Northwest to create vital, sustainable local economies catering to technology workers now able to sustain well-paying work outside of dense urban tech centers. — This opportunity allows localities to enjoy the tax revenue of high-income — residents without the accompanying disruption to economic balance, or tax breaks to companies associated with the more traditional introduction of business facilities (factories, offices, etc.). — The impetus is on the locality to provide the essential building blocks of a lifestyle city attractive to this influx: broadband internet and attractive activities unique to the community (restaurants, culture, local specialties) are a minimum. — Communities will need to leverage their intrinsic value- natural beauty, local attractions, and existing infrastructure that can be upgraded or pivoted to create a balance of quality living accessible to both existing populations and incoming talent. — Every move should be calculated to capture value, invite sustainable levels of growth, and invest in core capabilities; this begins with an intensive data analysis of local and regional factors. This article was authored by PNWER Innovation co-chairs, AK Sen. Mia Costello and Nirav Desai, CEO of Moonbeam Exchange, and was originally published as op-ed in the Anchorage Daily News and Medium. As the roots of America were being established, Lisbon was one of the richest cities in the world. In 1755, an earthquake that caused a fire brought the Portuguese economy to a grinding halt. In that local crisis, Amsterdam and London displaced Lisbon’s trading empire. A crisis that closed down one city displaced a global empire. The COVID-19 pandemic has shaken the world economy to its core — bringing cities and national economies to a grinding halt. But like any large machine, the U.S. and global economies will need an orderly restart to get humming again. We will recover from this, but economic patterns have changed. Localities that identify these changes and innovate to address emergent challenges will be the ones that prosper. As we reopen the economy, what lessons will we learn, and how will we retool to make the Pacific Northwest economic region even more vibrant than it was? Framework While we are still in the midst of this crisis, we propose that when envisioning the creation of a “New Normal,” we consider four distinct but overlapping phases of the response: (1) health security, (2) economic restoration, (3) economic retooling, and finally (4) the new normal. Phase One: Health Security First, we need to stop the spread of COVID-19 while keeping the health care system functioning. It appears that social distancing, while resulting in a halting of the economy, is working to do this. However, as a nation, we cannot go on too much longer. We need to develop a plan that reopens the economy in a safe way and in a way that minimized downstream health and economic problems. Phase Two: Economic Restoration Once economies open for business, we will not be able to go back to work as normal. Assuming that economies open up again in early July, businesses need to start planning now for the contingency of a second wave causing us to need to take similar measures in December. In that time, companies need to create and train for a new normal, repair equipment and get factories humming again, and plan for a second wave. While travel will start up again, there will likely continue to be travel restrictions, more shift work, and more regular health checks and compliance guidelines. Further, international supply chains will continue to be a challenge. Key to economic restoration is that we must make sure that producers and industry to keep functioning. This will make the task of supporting adjacent businesses (e.g. suppliers, shops, restaurants, and small businesses that cater to anchor industry workers) to get back on their feet and thrive easier. Further, we need to think about how to get the region exporting again. Phase Three: Economic Retooling The crisis has uncovered gaps, vulnerabilities, and strengths. It is also likely to change consumer and industry behavior. With all these changes, we need to:

Phase Four: Creating the New Normal The first three phases are traditional recovery. But then traditional recovery activities end, we will be living in a new reality. We need to harness innovation to challenge industry to address the gaps globally, and export capabilities that:

Lessons Learned As this crisis continues, our lessons are mounting. The pressure on the health system and the shelter-in-place orders uncovered conditions in society that leave us all vulnerable. There were also some notable successes — where technologies and innovations, though developed for other reasons, made the economy a bit more resilient. And COVID-19 made us think of other issues and risks that, while perhaps not causing problems in this crisis, could fail in a different crisis. What Went Wrong — Vulnerabilities and Gaps Health capacity is limited — For years, there has been an effort on efficiency in health care which has limited the number of unused hospital rooms and constrained deployment of technology. As such, the U.S. health care system operates far too close to its capacity on a typical day that it is ill-equipped to surge for a crisis. Technology access — With shelter-in-place orders, knowledge workers and schools were forced to telework. Internet access has proven vital to the functioning of the economy and should be viewed as a utility. The technology sector was able to migrate to remote work quickly. More risk-averse industries suffered and companies whose employees had limited internet access suffered. Education — We failed our children by not having a mechanism to ensure their education continued through shelter-in-place orders. While many private schools transitioned to on-line learning, public schools did not fare as well — not due to a lack of trying, but due to equity issues such as availability of computers and the difficulty of essential workers to supplement learning. Unexpected Successes Industry 4.0 — There has been a trend toward increasing automation in manufacturing. While this has resulted in job losses for years in the manufacturing sector, in an age of social distancing, this has proven to be vital for production. E-commerce and delivery services — E-commerce platforms like Amazon and delivery services like Uber Eats were developed for consumer convenience. During this crisis, they served as essential services. It has been amazing to see dine-in restaurants transform into delivery and take-out institutions overnight. Grocery delivery services have made it possible for people in vulnerable demographics to get basics without needing to leave their house.  Photo Credit: Andrea Piacquadio (https://instagram.com/andreapiacquadio_/) Photo Credit: Andrea Piacquadio (https://instagram.com/andreapiacquadio_/) Web Conferencing — One of the stars of the quarantine was web conferencing services like Zoom and Microsoft Teams. Services that were built, to a large extent, to support global outsourcing and remote team collaboration have been redeployed to functions as broad as enabling children to attend school, telemedicine, and even on-line benefit concerts. And novel applications of virtual reality for virtual conferences and remote white-boarding sessions show promise that we can progress even further. Adjacent Risks Food security — We are starting to see an impact on slaughterhouses and farm harvests, but the general availability of food was not overly impacted. As the crisis drags on, this might not remain the case. Infrastructure — Airports, rail corridors, and civic infrastructure have benefited from a scarcity of use since mid-March. Had this happened in more adverse weather conditions, it would have been difficult to repair infrastructure while also keeping workers safe. Distribution/Logistics — We are seeing farmers throwing away tons of crops in a time when grocery store baking aisles are empty. We have not seen a lack of food, rather that it is not packaged for the new patterns of consumption. Likewise, our logistics systems have stood up well, but we have been acutely aware of their criticality. Capabilities to Leverage The Pacific Northwest region fared well following the Cold War and in the post-9/11 world. It was during this time that Microsoft took off, Amazon was born, Vancouver boomed, etc. The region became global leaders in cloud computing, artificial intelligence, immersive technology, cyber-security, enterprise technology, biotech, unmanned systems, agriculture technology, global health, and additive manufacturing. These capabilities form the core of what is needed for the emerging economy. Cloud computing and immersive technology are coming together to allow greater remote work and telemedicine. Robotic process automation and enterprise technology applied to agriculture and logistics are critical to building redundancy and resilience in the global economy. Innovation is critical to business resilience. Companies that have embraced technological innovation have fared the best during the crisis. This is particularly notable by the resilience in the stock price of technology companies like Amazon and Microsoft. They continue to operate with little to no impact on productivity. Remote work: A remote workforce is needed for business resilience. Companies that have a culture of flexible work agreement have fared well during this crisis. AgTech: We need to identify ways to connect the knowledge economies along the coast with agriculture and logistics needs inland and throughout the region. Autonomy technology is vital in agriculture and logistics for food security. Recommendations To build the next global economy in the PNW, we need to bring industry and government across the region to work in tandem. In much the way that the moonshot challenged industry to build the core technology that led to the internet cell phones, and a global satellite network that allowed many of us to work from home the past two months, the challenge of pandemic resilience should be viewed as an opportunity to challenge this generation to invent, build, and commercialize technology that will be the basis of tomorrow. Elements of this are already happening. We recommend the several initiatives to ensure that the Pacific Northwest emerges from this crisis stronger than we entered it. Cross-Sector Industry/Government Collaboration: Public-Private Partnerships that develop common repositories for policies, procedures, and training related to health security, but that also identify gaps vulnerabilities and emergent threats. Governments should focus on the identification of risks to health, security, and economy and they should challenge industry to address these risks. Some examples of these challenge-based investments in emerging industries could include:

Together we will build a stronger region, but we need to do this smartly! This article is a submission by PNWER contributor, Jan Greylorn, and does not necessarily reflect the views of PNWER. This a submission to the Harvard Kennedy School Belfer Center Applied History Project https://www.belfercenter.org/project/applied-history-project#!contest:-applying-history-to-covid-19 In November, we will have an election.

Covid-19 will be an issue. We may be in a harsh "second wave" as happened with the 1918 Influenza. We may see Covid-19 decline and the glimmer of a vaccine. Regardless, the economy will be different. Change will accelerate. Each candidate will have to deal with our experience, real costs (lives and treasure), problematic preparation and execution, and the risks of the "next one". A candidate may choose to ignore the painful experience. To a certain extent, we did that after 1918I[i]. Or they may release thick position papers and promise to do better with what we have. Or a candidate may understand his base and look to Applied History for real measures that will resonate with voters and do the necessary hard things. Covid-19 is the most serious attack on the United States in our collective lifetimes. To date, the virus has killed 100,000+ of our citizens and cost over $4,000,000,000,000 (4 trillion dollars). More death and economic damage will certainly follow. The US Covid-19 response was fragmented, leading to a shutdown which led to an economic crisis and the worst unemployment since the 1929 depression. Social unrest is already evident. Political and national security upheavals may follow. We now know the very real Pandemic risks and consequences. We were warned[ii]. In 2015[iii]Bill Gates laid out four things we need to meet the threat of pandemics: surveillance & data, personnel, treatments, and equipment. He said the failure to prepare would lead to increased death and cost. He was right. Gates urged the development of a medical reserve corps, joint medical and military efforts, germ-focused war games, and stepped-up medical research. Covid-19 is what he called the “next one” after the well-studied 1918 Influenza pandemic. The one after Covid-19 could be even worse. Globalization and mass air travel have turned weeks or months of warning into days Applied historical analysis[iv] tells us that we will need a unified response, an integrated system of planning, preparation, and execution. In 1946, memories of the Nazi blitz, Pearl Harbor, Hiroshima, and the frightening power of massive aerial attacks were the basis for the creation of the Strategic Air Command (SAC)[v]. SAC’s mission was to deter and counter threats with effective reconnaissance, intelligence, planning, resources, and operations. SAC had money, people, material resources, R&D, plans, coordination, and war game verification. SAC also had a SIOP, a Single, Integrated Operations Plan[vi]. We need something similar now – a Strategic Pandemic Command (SPC) with a single, integrated operations plan for Pandemics (PSIOP). Its mission would be to defend the country against biological threats and to plan for post-threat recovery. SPC would monitor all points of entry for biological threats. SPC would protect key interior assets like the health care system, economic nodes, senior citizen life care facilities, and supply chains. It would muster necessary resources including dedicated operational bases, communications equipment, and strategic stockpiles for its partners in city, county, state, and regional jurisdictions. It would refresh and update strategic stockpiles as they age. It would use and support US vendors with periodic purchasing through the domestic supply chain, monitor how that chain integrates globally. and test the chain’s capacity to meet surges. The SPC would use global reconnaissance to detect threats. International cooperation would be important. A “trust but verify” process would include the support of nations and international entities with converging interests. The SPC would coordinate research and development for threat detection, defense, mitigation, treatment, and other needs. It would also conduct its own research and supply grants to other organizations, including foreign allies. The SPC would coordinate with both public and private entities across the health and education sectors. It would provide those entities with federal resources and templates for action. Finally, the SPC would use war games to test operational responsiveness under normal, partial, and full-scale deployments of its resources. It could also use standard events, like the annual flu season, to test its responsiveness. Lessons learned from these simulations would strengthen SPC’s preparedness and pave the way for effective post-threat recovery. The Strategic Air Command’s SIOP was both detailed and flexible. Roles and responsibilities were clear. It evolved and changed over time as threats and capabilities mutated. The Strategic Pandemic Command and its PSIOP should have all that and more. The next pandemic, natural or man made, could be far, far worse. No plan is perfect, but a plan and an effective planning process and execution beat hope and luck. We can and must do better. A Strategic Pandemic Command with an integrated plan modeled on SAC which protected us for a half century is a path to a better way. Mr. Jan Greylorn BA Biomedical History, UW BA History, Military History UW 20+ years Corporate Planning and Operations Research (Eddie Bauer, Nordstrom, T Mobile, Washington State, Cities, Counties, Military Associations ….) Click here for source and resource material Applied History Applied Historians begin with a current choice or predicament and analyze the historical record to provide perspective, stimulate imagination, find clues about what is likely to happen, suggest possible interventions, and assess probable consequences. https://www.belfercenter.org/project/applied-history-project#!about In the author’s humble opinion, Applied History

This article is a submission by PNWER sponsor, University of Washington, and does not necessarily reflect the views of PNWER.  When the University of Washington launched the Population Health Initiative nearly four years ago, it was necessary to explain the importance of studying the intersecting and overlapping factors that influence health and well-being both here and around the world. The Initiative’s cross-disciplinary approach to problem-solving was unusual in a university setting, encouraging researchers to collaborate on projects across traditional departmental boundaries. Today, the relevance of this work could not be more obvious. The COVID-19 pandemic has shined a spotlight on how profoundly important scientific expertise and data are for helping policymakers, business leaders and citizens understand both the scale of the pandemic and the response necessary to address it. From developing treatments and caring for patients to researching the virus and combating misinformation, UW faculty, staff and students are playing an integral role in the global response to COVID-19. Outstanding work is happening across our university to attack the problem from every angle. Our medical system staff are on the front lines providing extraordinary care to our community. UW researchers have sequenced COVID-19’s genome, identified the architecture and mechanisms of COVID-19, created a new laboratory test to expedite diagnostics, are testing potential treatments, built models to forecast the outbreak’s severity, and are crowd-sourcing a cure. Others are working to slow the viral spread of misinformation about COVID-19, 3D print face shields for hospital staff, locate and donate personal protective equipment, help monitor and understand the emotional impacts of self-isolation and provide resources to families whose kids are suddenly home 24/7. Public health experts are consulting with local governments and businesses about how to safely reopen when the time comes. Faculty and students are showing boundless creativity and compassion as they transition to online learning. Virology researchers are developing and processing antibody tests, computer science experts are developing a contact-tracing app. And the list goes on. The University of Washington and UW Medicine are proud to serve our community and State as we take on COVID-19. This work would not be possible without support from the state of Washington, the federal government and the private contributions of so many generous individuals. It is important to note that by its very definition, population health reminds us that the efforts of UW Medicine and the University of Washington are not in isolation – our work is interconnected with the herculean efforts of leaders in every sector of our economy and community. Daily, we are seeing the bravery of frontline essential workers, the tireless advocacy of community leaders and the sacrifice of those who are keeping their businesses closed and staying home. Thank you for all that you are doing personally and professionally to continue to reduce the spread and burden of COVID-19. In our region, the curve may be flattening, but we are still a long way from the finish line. From improving testing availability and contact tracing capacity, continued therapeutic and vaccine research, and understanding the safest and most equitable ways to reopen the economy, there is still much more work to be done to beat this disease. The University of Washington will continue to serve the community and State as we weather COVID-19 and beyond. By standing together – while physically apart – our communities will defeat this virus and recover from its devastating effects. |

Archives

August 2023

Topics

All

|

|

World Trade Center West

2200 Alaskan Way, Suite 460 Seattle, WA 98121 |

|